If you’re shipping goods to a country in the European Union (EU), you’ll need an EU VAT number to clear customs. This guide covers everything you need to know about VAT numbers and how to apply for one.

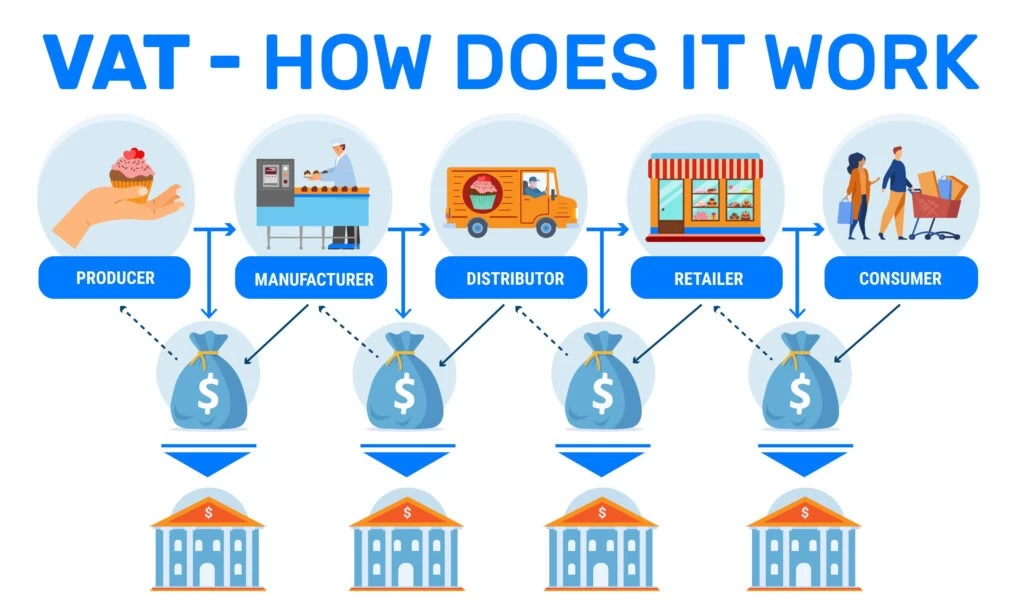

Value-added tax identification number (VATIN), or simply VAT, is a unique identifier used by the government that links to every taxable person or registered business. A VAT number allows tax authorities in the EU to track the movement of goods and associated tax liabilities on trading businesses.

Businesses require a valid VAT tax number if they move goods to and from the EU. They need to produce their VAT registration number even when applicable VAT is zero-rated – that is, when the goods have no tax liability, such as on intra-EU trades.

Each VAT number is verifiable on the official VIES (VAT information exchange system) website of the European Union.

What does a VAT number look like?

Every EU country has a unique EU VAT number format and associated regulations, typically a block of numbers and letters.

The number starts with a 2-letter country code followed by 2-13 unique alphanumeric characters. Here are some examples:

| Country | Country Code | Format | No. of Characters | Special Remarks |

|---|---|---|---|---|

| France | FR |

12345678901, X1234567890, 1X123456789, XX123456789. |

11 characters |

May include alphabetical characters (except I or O) as first and/or second characters |

| Germany | DE | 123456789 | 9 characters | |

| Netherlands | NL |

123456789B01 or123456789BO2 |

12 characters |

The 10th character is always B; companies forming a VAT Group have the suffix BO2 |

| Switzerland(Non-EU) | CHE | 123.456.789 |

9 characters followed by MWST, TVA, or IVA |

MWST: German partTVA: French partIVA: Italian part |

| United Kingdom(Non-EU) | GB | 123456789 | 9 characters |

Tip: Double-check the correct EU VAT number format when shipping to different countries. An incorrect VAT format on invoices and other shipping documents can lead to delays.

To register for an EU VAT number:

Note:

Although the specific list of documents depends on the country where you are registering for VAT, here are some typically required ones:

The United States is one of the few countries that does not require VAT registration for importing. However, the US does levy sales tax and other federal duties on imported goods in place of VAT.

Typically, importers to the US need an Employer Identification Number or EIN, which we’ll discuss later in this article.

In the meantime, if you’re exporting or importing to the US, you don’t need to worry about VAT tax number registration.

As of 2021, 170+ countries use VAT numbers on various goods and services.

These include all 27 countries that form a part of the European Union; these use the EU VAT number. Other major economies like the UK, Russia, Australia, Canada, China, and India require a VAT number for imported goods and services. Most Scandinavian and Latin American countries use VAT as well.

Find a complete list of countries with their VAT tax number formats here.

Both EU and non-EU companies require a VAT number to move goods across EU nations.

As per the EU VAT Directive, you’ll require a VAT tax number for shipping in four cases:

Confused about whether to get a VAT registration? Take this VAT Risk Assessment test to see when and where you need to get a VAT number.

If you’re based in the US or trading across the US, you may be familiar with EIN (Employer Identification Number).

How is an EIN different from a VAT number? Do you need a VAT number if you have an EIN?

Let’s go through some key differences between these two tax identifiers.

| Value-Added Tax Identification Number(VATIN) | Employer Identification Number(EIN) |

| Applies to all EU countries and other nations that use VAT | Applies to US businesses only |

| Unique 2-13 character alphanumeric code that links to all businesses registered for VAT tax numbers | Unique 9-digit number issued to businesses (or employers) in the US by Internal Revenue Services (IRS) |

| Tracks the movement of goods and tax liabilities of businesses trading in the EU | Tracks the tax liability of businesses trading in the US |

| You need a VAT number if you import or export to EU countries | EIN isn’t mandatory for foreign shippers importing into the US, but US-based exporters or importers require an EIN |

Note: You can have both EIN and VAT – based on the country where you do business. The EIN and/or VAT number also goes on the commercial invoice issued by the seller.

In most cases yes, especially when importing to the EU or any other country where VAT is applicable on imports.

However, certain regulations differ when selling within EU countries.

If you sell goods in different EU countries, you need a valid EU VAT number for each country where you have customers. Unfortunately, there is no unified Amazon FBA VAT number that can cover all EU nations.

However, the EU has a sales threshold limit for FBA sellers who are VAT-registered in a specific EU member country. This limit differs for each EU country.

If your annual sales in a country fall under that threshold limit, you don’t need to register for a VAT number in that country separately. In such a case, you can charge VAT according to your domestic VAT registration number.

Here’s an example.

Let’s say you’re an Amazon FBA seller based in Spain and want to sell in Germany (both EU member states). If your sales figure in Germany falls under their specified threshold amount (say, $10,000), you can charge your customers according to Spanish VAT tax rates without registering for a separate VAT number in Germany. In this case, you’d remit all the taxes collected by shipping to local Spanish tax authorities. However, if your sales exceed the threshold, you must register for a German VAT number and remit the tax collected from those sales to German tax authorities. The tax rates will also differ according to Germany’s VAT brackets.

Amazon’s marketplace has a vast network of sellers across EU countries. That’s why Amazon requires an EU VAT number from businesses trading in the EU before listing their inventory.

Don’t have a registered EU VAT number? Don’t worry! Amazon also offers VAT registration on its seller central portal with a third-party tax service provider. Here’s a video guide on how to register for a VAT number on Amazon Seller Central.

If you’re trading in EU countries, work with your providers to ensure VAT compliance. The system may seem daunting but once you get the hang of it, VAT makes it easy to track shipping tax liabilities.

sea freight companies best freight forwarder china to usa Warehouse services in China